RSI TRADING STRATEGY BACKTESTING MODULAR PROGRAM

These tools are designed to assist users in analyzing and evaluating trading strategies. They are not intended to generate direct buy or sell signals and is not recommended to be used as a signal-generating system. The developer is not responsible for any losses arising from the use of these tools, including but not limited to errors, limitations, or market conditions. Users are advised to seek guidance from a qualified market professional before making trading or investment decisions.

Scroll Down to know Full Details of the Backtesting System

Following are the Parameters Available for your backtesting

Custom Start-End Period

Test your strategy exactly where it matters most. With a custom backtesting period, you can choose the exact start and end dates for performance evaluation—whether you want to analyze specific market conditions, avoid irrelevant historical data, or focus on recent behavior. This feature gives you precise control and clearer insights into how your strategy performs during the periods that are most important to you.

Intraday Exit - Time Set

Automatically close open positions at a user-defined time before market close. This feature helps avoid overnight risk, aligns with intraday trading rules, and ensures clean day-wise performance tracking. It’s essential for traders who want disciplined exits and accurate intraday backtesting results.

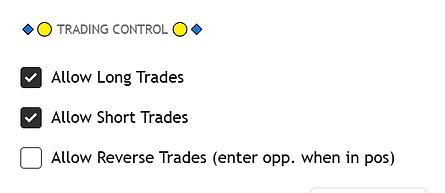

Long only / Short only

Gain full directional control over your strategy by choosing to trade only long positions, only short positions, or both. This feature is especially useful for markets with directional bias or for testing how your strategy performs in bullish versus bearish conditions. It helps isolate performance, reduce unwanted trades, and fine-tune your strategy to specific market environments.

Risk Reward Exit

Set precise Take Profit and Stop Loss levels based on your preferred risk–reward ratio. This feature automatically manages exits by calculating targets relative to your entry price, ensuring disciplined trade management every time. Whether you aim for steady gains or aggressive targets, risk–reward exits bring consistency, reduce emotional decision-making, and give your strategy a professional, rule-based edge.

POINTS BASED RR

Define your Take Profit and Stop Loss using fixed price points instead of percentage or ATR-based levels. This gives you full control over exact market distances, making it ideal for instruments with predictable tick movements or strategies that rely on fixed-range setups. Points-based R:R ensures clarity, precision, and consistency in both backtesting and live execution.

Pips Based R:R

Define your Stop Loss and Take Profit using pip values, making this feature ideal for forex and currency-based instruments. Pip-based RR ensures precise, standardized risk control across different pairs and timeframes, helping you maintain consistent trade sizing and realistic backtesting results tailored to FX trading.

Ticks Based R:R

Set your Stop Loss and Take Profit using tick values for maximum precision. This feature is ideal for futures and instruments where price moves in defined tick increments. Tick-based RR ensures accurate risk calculations, consistent trade management, and highly realistic backtesting aligned with actual market mechanics.

% based R:R

Manage your trades using percentage-based Stop Loss and Take Profit levels relative to the entry price. This approach automatically adapts to price scale and volatility, making it suitable across different instruments and timeframes. %-based RR delivers consistent risk management and reliable backtesting without manual recalibration.

ATR Based R:R

Define Stop Loss and Take Profit levels using the Average True Range, allowing exits to adapt dynamically to market volatility. ATR-based RR helps prevent tight stops in volatile conditions and avoids oversized targets in low volatility. It’s a smart, adaptive risk management method that improves trade consistency and realism in backtesting.

Reversal Trades

Enable your strategy to instantly reverse direction when an opposite signal appears. Instead of waiting for a full exit, the system closes the current position and enters a new trade in the opposite direction. This helps capture sharp trend changes faster, reduces idle time, and ensures your strategy stays aligned with real-time market momentum.

Disclaimer :

These tools are designed to assist users in analyzing and evaluating trading strategies. They are not intended to generate direct buy or sell signals and should not be used as a signal-generating system. The developer is not responsible for any losses arising from the use of these tools, including but not limited to errors, limitations, or market conditions. Users are advised to seek guidance from a qualified market professional before making trading or investment decisions.

Why Should You Buy This?

-

Test Before You Trade

Validate your RSI strategy ideas using real historical data instead of assumptions. -

Save Time & Effort

Skip manual backtesting and repeated chart analysis with a ready-to-use system. -

No Coding Required

Adjust entries, exits, and risk settings using simple dropdowns and inputs. -

Flexible Strategy Testing

Experiment with multiple RSI rules, risk–reward models, and trade modes in one program. -

Clear & Visual Results

See trades, TP/SL levels, and performance directly on the chart for better clarity. -

One-Time Purchase

Use, modify, and access the program freely on your TradingView account. -

Reduce Costly Mistakes

Identify weak logic and poor risk setups before risking real capital. -

Built for Serious Testing

Designed specifically for structured backtesting—not just signal plotting.

INR 999/- Only

INR 5000/-

Offer Valid till Jan End Only !!!